The whole financial industry might sound like a song on repeat right now. Yes, the markets are down, and yes, it is going to be OK. In the spring, I wrote to my clients about how the war in Ukraine didn’t foretell a market downturn. But then it combined with higher gas prices, rising inflation, and the Federal Reserve’s attempt to quell the inflation with rising interest rates. Where before we had been saying, all of these signs point to an economic downturn, that seems like where all of the pundits want to say we are going. But if we remain calm and look at the historic data, remaining stable and even investing more could be beneficial for your portfolio.

The Reality of the Market

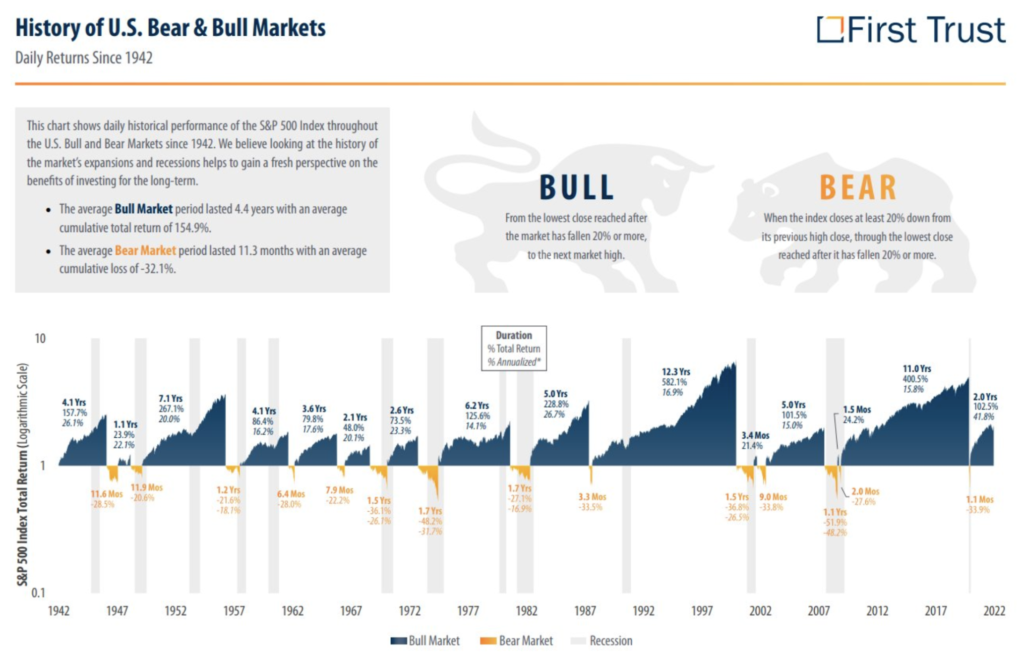

In June, the S&P 500 fell into a Bear Market. A Bear Market happens when there is a decrease in value of more than 20%. This came as an especially shock since the market was up 20% in January. Since 1942, Bear Markets have lasted between a little over a month or up to a year and a half. Sometimes they coincide with recessions, sometimes they don’t.

Normally, the Federal Reserve steps in to lower interest rates and increase market growth. But, they’ve done the opposite because of rising inflation. Inflation is up over 8%, which many people have seen in prices at the supermarket and the gas pump. This all means that you may have been less than pleased with your mid-2022 portfolio assessment. Many of us were riding high on the growth in the market despite our worst fears in March 2020 when the COVID pandemic hit. Now, we are contending with a Bear Market and inflation.

The Long Term is the Right Term

At Montgomery Financial Partners, we are in the business of helping people plan for the long term. While you may have immediate financial goals, we help you consider when your kids go to college, your 401(k), and your retirement. For many of our clients, retirement isn’t right around the corner. And in a market like this, time is on your side.

If you look at the chart above, you see that the longest Bear Market lasted just over 1.5 years. Most of us have that long to wait before retirement. However, the average cumulative total return during Bull Markets was almost 155%. The historical data shows us that if we wait 5-15 years, the markets not only recover but increase in value. Now, you might be thinking that 5-15 years is a long time, but financial planning should be about the long term. And staying relaxed, no matter how stressed you are now, is the best plan.

Risk Tolerance and Volatile Markets

Every investor is different, and this is especially true at a moment like now. If you have more than 5 years until retirement, your plan will look different from if you are currently in retirement or have 20 years until retirement. Let’s start with if you are in retirement right now and worried about what you draw from your accounts. The New York Times suggests that retirees revisit expenses, still delay taking Social Security, and reexamine their debt. If you have less than 5 years until retirement, you may want to calmly sit where you are and wait for the markets to recover. Investing more at this point could be risky.

However, if you are farther out from retirement, this Bear Market might be the time to invest more. Of course, make sure that you are paying your expenses and have an emergency fund. But, you can consider buying diverse stocks, with a 10+ year return in mind. Even the worst 20-year return since 1942 was +6%–meaning it is still better to put your money in the market than in a savings account or under your mattress.

So, take a breath and think of the long term. If you have any questions about your investments or portfolio, don’t hesitate to contact our office.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc. a Registered Investment Advisor. Cambridge and Montgomery Financial Partners are not affiliated.

This communication is intended for people in the following states: AL, AZ, CA, DC, FL, MA, MD, MN, NC, NJ, NY, OH, OR, PA, SC, TX, VA, VT, WA, WV

This site contains third-party links. The information being provided is strictly as a courtesy. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites you are linking to. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website.

Recent Comments